Budget Malaysia 2013 speech (excerpt):

138. Moderate intake of sugar is acceptable. However, if taken

excessively, it may be harmful. To date, about 2.6 million suffer from

diabetes. In this regard, the Government propose to reduce the subsidy on sugar

by RM0.20 per kilogramme, effective from 29 September 2012. The Government

urges the business community not to burden the rakyat by increasing the price

of sugar but instead reduce the content of sugar in food and beverage.

http://www.nst.com.my/2013budget/full-text-of-the-2013-budget-speech-1.149226

http://www.nst.com.my/2013budget/full-text-of-the-2013-budget-speech-1.149226

Based on the link http://www.nst.com.my/2013budget/full-text-of-the-2013-budget-speech-1.149226, when tabling the Budget 2013, Malaysia

Prime Minister Datuk Seri Najib Tun Razak has announced the reduction in sugar

subsidy by 20 cents per kg starting from 29 September 2012. This policy was

implemented a day after it was announced in an effort to curb the soaring

diabetes among Malaysians.

First and foremost, a subsidy is a grant

given to lower the price of a good. It is a part of government policies to

alter the behaviour of businesses and consumers. In sugar industry, this policy

influences the way sugar suppliers and consumers behave i.e. how sugar subsidy

influences the supply and demand for sugar.

Surprisingly, Malaysia is the only country

with a sugar subsidy – this policy commenced in 2009. Over the first three years,

government has allocated huge amount on sugar subsidy. At the first place, the purpose

of the policy is to sustain the sugar price at the current level and to reduce

the burden of the targeted people especially the poor. In fact, will it

actually benefit the poor the most? It

seems to me that the riches also benefit from the sugar subsidy. For example,

riches in Malaysia have disposable income of thousands a month but they can

benefit from the sugar subsidy. So, does it fair to the poor? Moreover, it is

recorded in the history that subsidy policy has never abolished poverty among

the community.

Nevertheless, when Budget 2013 was tabled,

it is clear that the government wants to change its policy. The government

reduces the sugar subsidy to combat diabetes among Malaysians. Besides

diabetes, this policy is also to educate people to avoid over-consumption of

sugar which will also lead to other diseases; obesity, heart disease and dental

caries. I think this reduction of sugar subsidy is a good move as it may reduce

RM750million government expenditure which the money can be invested into more

focused projects that can help the lower income earners most effectively. By

lowering the sugar subsidy, the government may also subsidize on other

commodities which are more important and essential such as health and

education. The move is also to enable Malaysia to shrink its deficit and boost

its economy and development.

In the first year of the sugar subsidy practice,

government allocated 60 cents per kg for sugar subsidy. This incurred a total

cost of RM720million. However, recently the reduction of sugar subsidy to 34

cents per kg has raised the sugar price to RM2.50.

Date rise

|

Original retail price, RM/kg

|

Price increase, RM/kg

|

New retail price, RM/kg

|

1 January 2010

|

1.45

|

0.20

|

1.65

|

16 July 2010

|

1.65

|

0.25

|

1.90

|

4 December 2010

|

1.90

|

0.20

|

2.10

|

10 May2011

|

2.10

|

0.20

|

2.30

|

Table 1: Sugar retail price in Malaysia

Year

|

Sugar Subsidy (millions)

|

2010

|

RM720

|

2011

|

RM262.2

|

2012

|

RM567

|

Table 2: Sugar subsidy in Malaysia

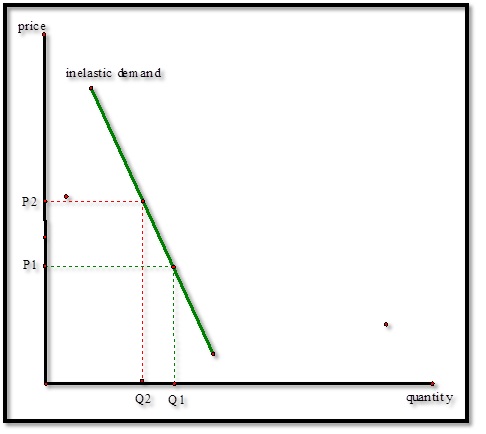

Graph 1: Demand

curve for sugar

Referring to

Graph 1, demand for sugar experiences a steady growth over the past 10 years.

It clearly shows that the consumption of sugar among Malaysians keep increasing

despite the increase in sugar price every subsequent year. Why do people still

buying sugar although the sugar price increases? It may be because of the culture of Malaysians to consume a lot

of sugar in prepared food and food eaten out at the home. People from Eastern

Malaysia, for instance, may find sugar as their basic needs because they use

sugar a lot in preparing their daily meals. Because of that, they are willing

to purchase sugar at nearly any price. Although some people and consumer

organizations clarify that sugar is not a basic necessity, but in my view,

sugar is almost a necessity for Malaysians. It is difficult to group sugar into

particular type of goods because different people may have different needs for

sugar.

To look further

into economic side, the factors that lead to increasing demand for sugar are

population growth and rising income. As the size of population grows, the

demand for sugar also increases.

In most of

goods, as income rises, consumers will buy more goods. However, income effect

does not significantly influence the demand for sugar as it is not a normal

good that people would buy more as their income increase. The demand for sugar

may not increase so much in relative to the increase in income. So, sugar is an

income-inelastic product.

Even though

sugar price increases almost every year, the increase in sugar price in

Malaysia is considered reasonable and affordable as compared to other countries

like Indonesia and Singapore. As the demand for sugar is less sensitive to

price changes, the demand for sugar is relatively price inelastic. It is price inelastic because the percentage

change in quantity demanded ([Q1-Q2]

2) is lower than the percentage change in price ([P1-P2]

2), resulting in very low price elasticity that changes in price have

little impact on demand.

Graph

2: Inelastic demand

Graph 3: An effect of a subsidy cut

The graph above illustrates the effect of

reduction in subsidy by 20 cents in response to the Budget 2013 proposal. The

“D” represents demand curve i.e. the relationship between the quantity demanded

of sugar and the price of sugar. The “S1” represents supply curve i.e. the

relationship between the quantity supplied of sugar and its price when all

other determinants remain the same. At the curve “S1”, the government imposed a

subsidy of 54 cents. On the other hands, the “S2” is the supply curve minus 20

cents subsidy i.e. the subsidy imposed on sugar now is 34 cents. At 54 cents

subsidy, the demand curve D and supply curve S1 determine the price of sugar at

RM2.30 per kg and the quantity produced is at Q1. However, the

reduction in subsidy shifts the supply curve S1 leftwards to S2. The

equilibrium quantity reduced to Q2, the price climbs up to RM2.50

and the price received by suppliers decline to just below RM2.30. In the new

equilibrium, the marginal social benefit (on the demand curve) exceeds the

marginal social cost (on the supply curve). This is because of the imposition

of subsidy which results in inefficient underproduction. However, the reduction

in sugar subsidy has at least reduced the impact of underproduction.

In sum, subsidy may be a good move to

control the way businesses and consumers behave in response to the economic

changes. However, subsidy is an expense to the government. Because of higher

demand for sugar, government has to allocate more subsidies on higher unit of

production. So, it makes sense that the government is trying to rationalize the

sugar subsidy. In order to rationalize subsidy, a long revision and adjustment

should be made. It may take a long time to abolish the sugar subsidy because it

has to be done periodically, by steps; not to shock the consumers.

Hello,

ReplyDeleteThanks for sharing this information regarding sugar supplier... The detail explanation is great and will be very assisting for all the consumers...Very nice post.......

wholesale bulk sugar